How MVsharp from Prosol Group helped a mid-tier regional insurance company dramatically improve performance and embrace innovation while preserving existing MV workflows

CLIENT PROFILE

BUSINESS CHALLENGES

MVsharp SOLUTION

IMPLEMENTATION APPROACH

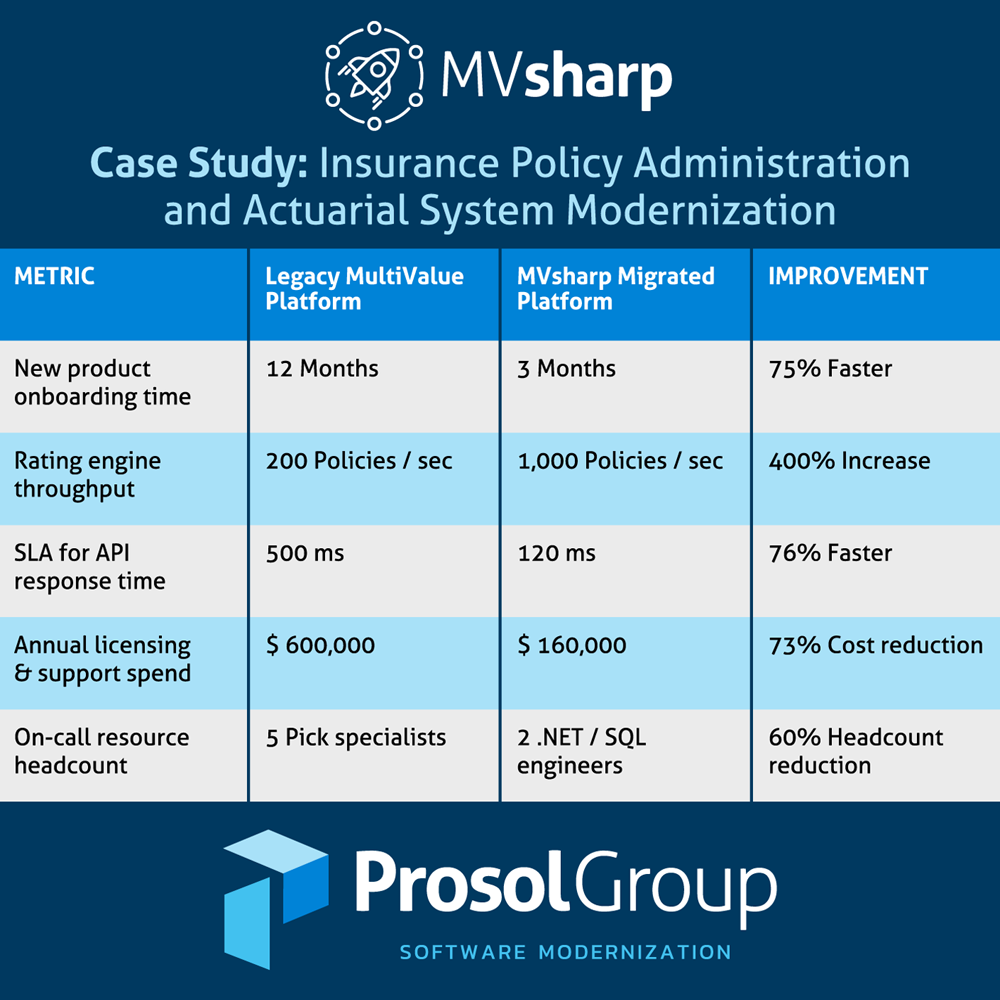

BUSINESS IMPACT AND ROI

DISCOVER MORE

MVsharp, developed by Prosol Group, empowers organizations to emulate legacy MultiValue environments like UniVerse, UniData, D3, and Pick – and generate fully managed .NET source and object code. The platform transforms and populates modern databases such as SQL Server, DB2, and Oracle, delivering high-performance, scalable applications that meet today’s enterprise demands.

To learn more or to arrange a demo, please email us on info@prosolgrp.com

To download this case study in PDF format please Click HERE

Share Article